top of page

Search

SIP: The Secret Weapon of the "Lazy" Investor

What is a SIP? (The "Subscription" Model) Think of a SIP like a Netflix or Spotify subscription for your future self. Instead of trying to find ₹1 Lakh to invest today, you tell your bank to automatically send a smaller amount (say ₹2,000) to your chosen Mutual Fund on the same date every month. It turns investing from a "one-time event" into a "lifestyle habit." The Power of "Rupee Cost Averaging" This is a fancy term for a very simple benefit: Buying the dip, automatically.

2 days ago

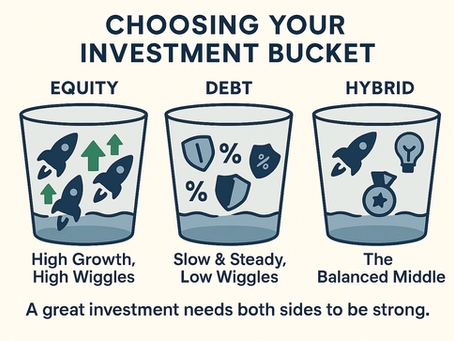

The "Potluck" Party: An Introduction to Mutual Funds

The "Community Pool" Analogy Imagine you want to invest in the stock market, but you only have ₹5,000. With that amount, you might only be able to buy 2 or 3 good shares. If one of them performs badly, your entire portfolio suffers. Now, imagine you and 99 other people each put your ₹5,000 into a single, giant "pool" of money. Now the pool has ₹5,00,000! A Mutual Fund is literally this "mutual" pool of money collected from many investors. The Professional Driver (The Fund M

3 days ago

Beyond the Numbers: The "Invisible" Factors of a Great Stock

The Jockey, Not Just the Horse In horse racing, you bet on the horse, but you also check who the jockey is. In business, the "jockey" is the Management Team . Integrity: Does the CEO have a clean track record? Do they treat minority shareholders (like you) fairly? Vision: Does the leadership have a clear plan for the next 5 or 10 years, or are they just reacting to whatever happens today? The Mentor’s Tip: Watch an interview with the CEO. Do they explain things simply, or

3 days ago

bottom of page